With an endorsement from Nassim Taleb on the cover of his new book , and a mention in an excellent Econtalk podcast last week, I just had to go see Robert Shiller talk today about the Subprime Solution.

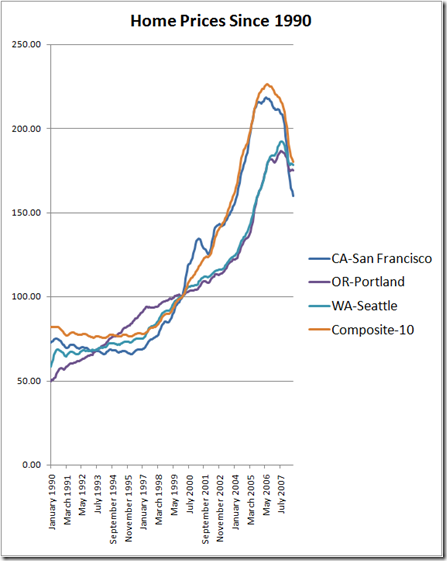

After running through a list of astonishing events that occurred since publication just one month ago, he spoke about the huge, unusual runup in housing prices over the past decade, how that was completely out of line with historical norms, and why the future doesn’t look good for housing prices (ha!). By the way, did you know that all the home price information for various cities is available as a simple Excel sheet on the Standard and Poor’s web site? (Here’s the info for Seattle)

He has an interesting idea for how to prevent future housing meltdowns. Why do millions of people have such a huge amount of their personal wealth invested in a single asset (their home). Why not create a security that lets homeowners spread or hedge that risk across more diverse assets? He suggests creating mortgage products where the price fluctuates on the underlying value of the home. Presumably this would lower the return on investment, but protect you much better in the case of falling prices.

Interesting ideas…too bad the finance people are too busy to think about this right now.

[update: oops, I spelled Shiller incorrectly with a 'c' in the first version of this post]

No comments:

Post a Comment